At the moment, the most popular cryptocurrency on CoinMarketCap, the world’s leading cryptocurrency price tracking website, is Safemoon crypto. Its quick growth rate is likewise somewhat astonishing.

The insane FOMO sentiment has thoroughly encouraged individuals to pursue Safemoon crypto, and a group of believers have carried their passion for it from online to offline, much like they did with Dogecoin previously, and their enthusiasm has even expanded to the Chinese Internet. A rising number of individuals believe it is a coin worth ten thousand times its face value.

So how did Safemoon crypto become so popular? To begin, let us examine the ideas underlying Safemoon crypto.

31st January 2022 Update: Safemoon’s market value has surpassed $2 billion since its introduction in early March 2021, with a rise of up to 8,880 percent in a single month.

What is Safemoon Crypto?

Safemoon crypto is a BEP-20 token launched on March 8, 2021, in the Binance Smart Chain (BSC) ecosystem. BSC is a centralized finance ecosystem that clashes with Ethereum’s decentralized finance (DeFi).

Safemoon crypto has rapidly grown in market valuation to become Binance’s third-biggest coin.

According to Safemoon website, cryptocurrency is composed of three primary components. The initial stage is reflection where its transactions incur a cost that is distributed amongst token holders.

The second is a transaction fee that will be distributed across several liquidity pools on PancakeSwap and other platforms.

The third is the burning of tokens that occurs at the end of each transaction. White paper and the rest of the website say nothing about the last part.

5% were awarded reflection prizes and 5% were awarded liquidity pools. To ensure the financial viability of the Safemoon and Binance Coin pair, 2.5% of the 5% paid for liquidity pools are converted to Binance Coin (BNB).

The Safemoon whitepaper notes that the team intends to make the tokens burn manually. These burns do not appear to be pre-programmed into the Safemoon protocol but will be carried out at the team’s discretion.

Managing a passionate team and rewarding them for what they have achieved helps to keep the community motivated and knowledgeable. Safemoon’s burn method is intended to be useful and gratifying for long-term participants. Additionally, the total quantity of SAFEMOONs burnt is displayed on our website’s readout.

It is unknown what criteria the team employs to make these decisions, or how much authority the team has when it comes to modifying Safemoon’s maximum supply. The team’s capacity to burn tokens at will might allow for possible supply and price manipulation.

2nd February 2022 Update: Safemoon is below the all-time high price of $ 7.97. The circulating share currently is 585,536,366,402,812 SAFEMOON.

Fees for SafeMoon Coin

Anyone selling Safemoon coins will be charged a fee of 10%, from which 5% will be redistributed to token holders and 5% will be directed to wallets with a separate currency, Binance Coin (BNB), controlled by the author of coins.

According to the founders of Safemoon, this trading fee is intended to prevent daily trading and to correct the high price volatility experienced by other cryptocurrencies. They assert that investors are shooting for money every month, but it will take time to get there.

Purchase Safemoon Crypto

How to Buy Safemoon Crypto?

To buy Safemoon crypto is not a straightforward process, but it is possible.

For buying, potential and any early investor must first set up a crypto wallet on the Binance cryptocurrency exchange and then buy Binance coins. These can change over time with safemoon coins.

Where to Buy Safemoon Token?

For purchasing this token first, download the Trust Wallet App which is available for iOS, Android, and Google Play.

Purchase one of two established cryptocurrencies now available: Binance or bowscoin.

Select the DApp tab in the Trust Wallet app to locate decentralized applications, and then search for PancakeSwap.

PancakeSwap enables users to swap binance or bowscoin for SafeMoon tokens. After that, those tokens are stored in Trust Wallet.

What Distinguishes SafeMoon Crypto from Bitcoin?

As previously stated, SafeMoon is a Binance Smart Chain-based BEP-20 token. Changpeng Zhao, the founder of Binance, has confirmed that BSC is not decentralized. Zhao dubbed BSC “CeDeFi” in a since-deleted tweet, which is an acronym for centralized DeFi and a bit of an oxymoron.

Proof Authority

Binance Smart Chain is based on a consensus process known as proof of authority. In authority proofs, the block creators are referred to as validators. Binance has pre-approved and selected these validators. They must verify their true identities, invest money to demonstrate long-term commitment, and be on an equal footing with all other candidates in order to be authorized. As a result, evidence of authority is by design reputation-based.

Binance maintains complete control over the blockchain under this arrangement. They appoint validators and remove validators at their discretion. All chain users must have faith in Binance’s ability to act in the chain’s best interests. Binance has the ability to adjust any component of the chain or ecosystem.

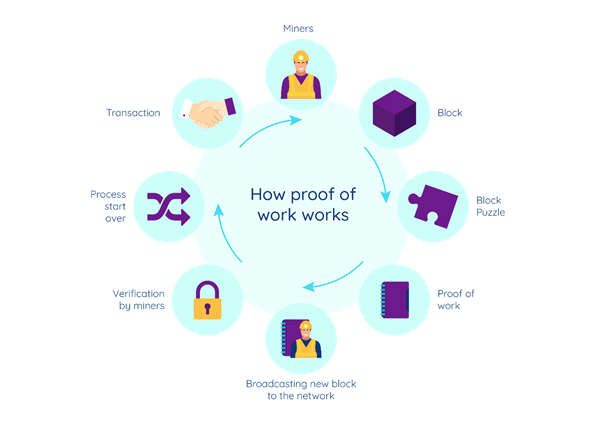

Proof of Work

Bitcoin has a wholly unique consensus technique known as proof of work. Proof of work was the initial consensus method employed by blockchains and has shown to be extremely successful at safeguarding a decentralized system against malicious actors.

Computers compete to process and validate transactions as proof of performance. The computer has to solve difficult math puzzles to win this challenge. Once they win, the computer updates the blockchain with a new transaction block. These computers, dubbed miners, are compensated with Bitcoin for successfully completing a new block of transactions.

This technique is extremely energy-intensive yet contributes to network security. A sufficient number of geographically spread miners results in a decentralized network without a central authority, which is diametrically opposed to the BSC’s operation. Bitcoin is now a widely dispersed and decentralized network with hundreds of thousands of nodes and miners located across the world.

Is SafeMoon a Legitimate Dogecoin or a Ponzi Scheme?

Safemoon crypto features an intriguing token approach in general, with the primary goal of assisting purchasers in obtaining rewards and exposing sellers to penalties. The initiative has not yet generated any commercial benefit. As a result, the Safemoon crypto price is now being driven mostly by the interest of groups and initiatives in the cryptocurrency industry.

No independent third party has examined and confirmed the SafeMoon protocol code. As a result, you should use extreme caution when using SafeMoon. Previously, BSC’s mysterious development staff perpetrated millions of frauds.

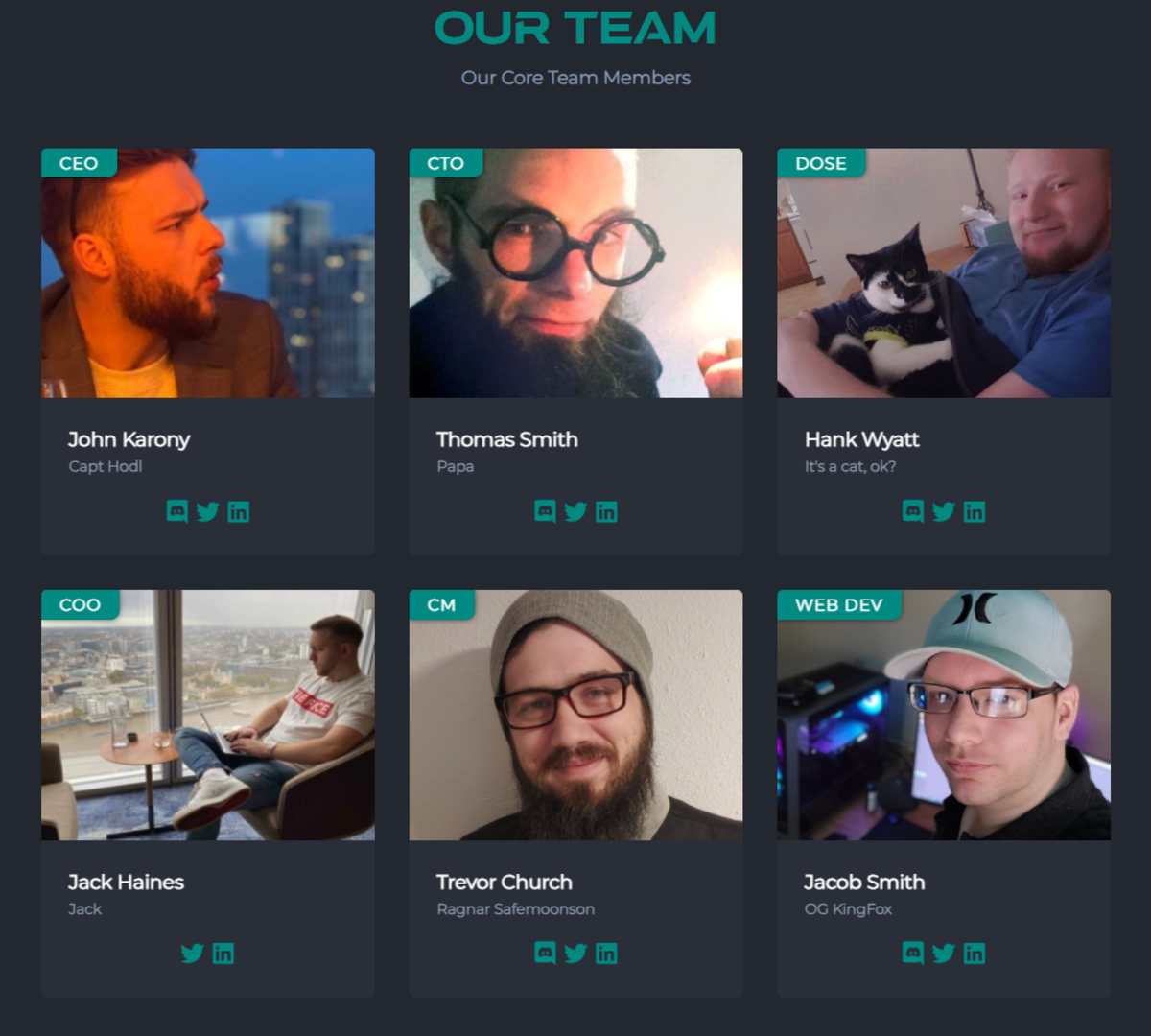

Safemoon Team

SafeMoon team is directed by CEO John Karony, who formerly served as an All-Source Analyst for the US Department of Defense.

Thomas Smith is listed as the Chief Technology Officer of SafeMoon on the company’s official website. He was previously the Chief Information Officer of Goldsmith Blockchain Consulting. The cryptocurrency token was launched on the Binance Smart Chain blockchain in March 2021. SafeMoon’s value increased following a wave of celebrity endorsements.

Is Safemoon a Sound Investment?

Safemoon has increased 3253 percent in value since its inception when it reached its all time high. Without a doubt, this coin is intended for one purpose—appreciation. All of Safemoon’s token economic designs encourage investors to hold digital currencies, as investors may earn passive income from transactions in this sort of economy. Increased investor interest has aided Safemoon’s growth.

Safemoon crypto has a strong community behind it, and investing in this coin is a wise move. However, you must first weigh all possible hazards. For instance, Safemoon, like other cryptocurrencies, has significant volatility. Additionally, it may run into the issue of inadequate cash. While Safemoon has a system in place to prevent this from occurring, it is not completely prevented. Safemoon token holders will be charged a 10% processing fee, which will be transferred to current holders.

Hazards Associated with Purchasing Safemoon Crypto

While purchasing Safemoon has a lot of promise, you should keep in mind that investing in cryptocurrencies is dangerous. For instance, the high volatility of cryptocurrencies is always a danger, since it can result in unanticipated currency price rises and falls. This can be triggered by anything, including price manipulation by whales. Given that the majority of currencies are still following bitcoin’s lead, it is not sufficient to focus just on Safemoon, but also on BTC and cryptocurrency markets.

Following that, if you purchase Safemoon cryptocurrency, you may like to experiment with leveraged trading. This is often quite successful for traders who understand risk management, but the more leverage you employ, the bigger the danger. Leveraged trading is typically conducted via contracts for differences, which implies that you may profit regardless of whether prices increase or decrease, as long as you can properly anticipate their trajectory. In other words, Safemoon price prediction is critical.

If your Safemoon crypto price estimate is true, you may earn a lot of money, but the more leverage you apply, the less the margin for error. That is why your Safemoon’s price projection must be quite precise, and why you should generally avoid using leverage until you have gained sufficient expertise to believe you are an encryption expert. On the contrary, you simply need to purchase Safemoon cryptocurrency in a conventional manner, as there is still sufficient danger for early investors.

Conclusion

You may invest in Safemoon crypto, but because of the high risk, you should not put all of your money. Additionally, even during periods of significant volatility, you may maximize your gain by using the average cost in dollars. This token has not yet demonstrated all of its potential, as you may know, it is now ranked 108th in terms of market capitalization among all cryptocurrencies.